Well,

friends, here it is—the how to make a budget post! Granted, there are countless

ways out there to make a budget; this is just what has worked wonderfully for

Corey and I. I’m going to try to make it as simple and user-friendly as I can,

but if you have any questions don’t hesitate to ask!

First,

remember my “get organized” post where I told you to list how much money you

make as well as all your monthly expenses? Well, there was a reason. It will be

absolutely key in creating your budget. If you haven’t done it yet, I strongly

suggest doing it now. And if you have, awesome! Get it out! J

Now,

as a warning, the first time you create a budget will without a doubt be the

most difficult. You’ll probably want to throw things. You’ll probably wish you

had more money. You’ll probably feel completely broke in the end. Keep in mind

that it does get easier and that

those feelings will go away the more you stick to the budget!

Next

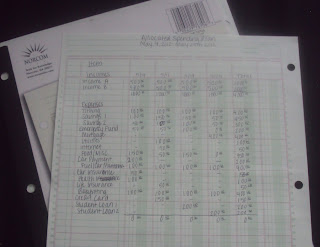

task—come up with a system. In my post on Friday, I posted a picture of the

columnar pad I use to create our budget. Personally, I like being able to write

it down, check it off, and carry it with me easily if necessary. However, if

you prefer using Excel, or anything more high-tech, that’s fine. And, before I

found my lovely columnar pad, I used a plain old notebook and that worked like

a gem too. You don’t have to be picky—whatever works for you! I would suggest

though to use something with lines, just to avoid confusion.

So,

before we go any further, I’ve posted a picture of a sample budget. And, as a

disclosure, this is very much not what our budget looks like—I threw this together

quick just to use as a reference (sorry, I didn’t really feel comfortable

broadcasting our actual dollar figures here—maybe someday!). After I finished,

I realized the pretend owners of this pretend budget have way fewer bills than I do and way

way more savings! Sorry about that! But anyway, here you are:

This wasn't so tiny on my picasa account...hmmm...

Maybe a bit better, but still kinda small...

I'm going to suggest that if you can't see it in the above pics (which, does not surprise me at all), to look at it through this link (that I realllly hope works!):

Clear

as mud, right? Let’s walk through it.

At

the very top you’ll see “Allocated Spending Plan.” This is also known as

budget. I get the fancy “allocated spending plan” term from the Dave Ramsey

class. He has you separate like this too, only his is a LOT more detailed.

Maybe the greater detail will work better for you—and again, I would encourage

you to take Dave Ramsey’s class. Dave’s class will also tell you recommended

percentages for each category. Why don’t I use this? Well, our debit is way above the recommended percentages,

and some of our items cannot practically stay within the guidelines. As an

example, our utilities are always extraordinarily high in the winter, but in

the summer it’s much closer. Another reason is that since I don’t use the

broken down version, it makes it less practical to keep Dave’s guidelines. For

us, it seemed a bit more realistic based on the way we live to do it this way.

When we first started Dave’s class, we did use the percentages though. Also,

Dave will teach you to use cash for certain items on your list. For instance,

on my list you’ll see the “Food/Misc.” category. This is one of the areas I

lump a LOT of things together. This is pretty much my all other expense except

monthly bills money. Dave would say that’s a no-no and to use cash for Food and

many of the other things I lump into that Misc. Personally, I’ve found that if

I have cash, I spend it. Period. I look at it as “I have this money, so I can

spend it,” and therefore do. Many people, as you learn from Dave Ramsey, spend

less when dealing with cash because they can actually feel the pain of spending

and see the money disappear. And if that’s the way you are, by all means use

cash! As I’ve said before, I’m just sharing what’s worked for us. Anyway, I’ll

say more about the “Food/Misc.” category later in this post and this tangent

has lasted long enough!

The

dates are the next part of the budget. May happens to be a nifty month that

falls into the four Fridays category, making the budget make the most sense.

However, depending on the day you choose to use as your “bill day,” this will

be adjusted. Say, for instance, Thursday is your bill day. Your dates would

technically be May 3rd, 2012-May 31st, 2012, and thus

you’ll end up with 5 weeks. If you find it easier to just add an extra week to

your budget, feel free to do so. Corey and I do it a bit differently though—I always use four weeks. So, to use the

Thursdays in May as an example, my budget would have May 3rd,

2012-May 24th, 2012. Then, my next budget would end up being May 31st,

2012-June 21st, 2012 and so on. The biggest reason I do this is

because I actually end up paying bills ahead, which ultimately ends up as more

money! J YAY!!!

Item

and Incomes are just labels—hopefully those make sense to you. The dates at the

top are each week’s bill day broken down. Again, hopefully that makes sense. As

I’ve said, feel free to ask questions if not!

And

now we’re getting into the fun part! J First, list your incomes below the “incomes”

title. Remember that this is actual take home pay, not pre-tax or anything like

that. Your numbers will most likely not be as clear cut as my sample numbers,

and that’s 100% okay. One thing that I’ve found useful when doing this is

rounding. If on a typical week I make, say $392.54, I would bump this down to

$390. That would leave the $2.54 as “extra” money, so to speak. Also, if your pay

isn’t regular, I would strongly encourage you to use the low end of what you

would make. When I worked at the bank, it would all depend on how many hours I

was scheduled, so I always went with the low end. Say I had the potential to

get a $500 check at the end of two weeks, but I also could make as little as

$300. I would use $300. This gives me a nice chunk of “extra” if I do make the

big bucks, but doesn’t cause a problem if I don’t. Which, speaking of—Corey and

I both get paid weekly at our current jobs, but if you get paid biweekly, or

even monthly, this will change your allocated income. Say you would get paid on

the 11th and 25th—that’s fine. Put those as your pay

dates and then pay your bills those weeks. It’s the same process. If any of you

need me to walk you through this more, feel free to tell me! Message me on

Facebook, leave a comment here, or whatever works. I’d be happy to create a

sample budget based on your schedule if that’ll make it make more sense! Once

you have your incomes all entered in, total them for each week, and in the

“total” column at the end.

Expenses.

Yikes. This is where it gets nice and sticky! First, list out your expenses.

I’m going to go through my sample list to hopefully make it a bit more clear:

1.) Tithing. Never will I tell you

that you must tithe. Do what you feel

God is calling you to do. I used the standard 10% when computing this, just for

simplicity’s sake. Don’t feel as if you must follow—give more, give less, don’t

give (though I lean more to the first two, I don’t want anyone to ever feel obligated to give to church… but I’m not

going to start a sermon, so that’s it!)

2.) Savings 1. This doesn’t

necessarily have to be a standard savings account. On Corey and I’s budget,

this is the savings account we have linked to our checking account. We put a

good portion of Corey’s check there automatically every paycheck with the goal

of putting it aside so we don’t spend it. We figure if it doesn’t ever hit our

checking, it has a good chance of not getting sent out. Also, we’re working on

paying off debt right now, so about once or twice a month I’ll move a big chunk

of what has went into this account to put towards Mr. Credit Card. If you have

something like this, cool! If not, that’s fine too. None of these items must be on your budget.

3.) Savings 2. I added this again

simply because it’s on our budget. Every week we put a small (much smaller than

what the crazy people who own my sample budget do!) portion of our money

towards an account for Tate. Our intention for this account is to use it if

ever an expense comes up for him that isn’t covered by our normal finances, not

for him to just have money socked away. If we get through his growing up years

without using it all, we’ll give it to him someday (maybe when he gets

married?). I eventually plan to post something about how to help children

handle finances, where I’m sure I’ll go more in depth about what we plan to do

with Tate, but part of this plan is that when he is old enough open up his own

account that the birthday money, odd job money, etc. would get put into.

4.) Emergency Fund. In Dave

Ramsey’s plan, your emergency fund is Baby Step 1. $1000 in the bank. Corey had

a savings account at a bank in Defiance before we got married that we’ve

allowed to act as our emergency fund. The bank doesn’t have a branch in Bryan,

so it makes access a little bit more difficult than our standard checking and

savings. We have a small dollar amount automatically going to this account each

week (not part of Dave’s plan, but since it’s a small amount, it makes me feel

comforted and we don’t miss it!).

5.) Mortgage. For some of you this

will be rent. I don’t think I need to explain that aspect. However, a couple

things. First, notice that in my sample budget this is listed the week of the

25th. I did this assuming your rent would be due on the 1st.

If you haven’t paid May’s rent yet, make sure you don’t miss it! Also, I would

like to add that for Corey and I our home insurance and property tax is

included in our mortgage. If yours isn’t, you’ll need to add lines for these.

Again from Dave, it’s a good idea to make use of a “sinking fund” for items

like property tax that come up irregularly, but yet predictably, throughout the

year. If you aside so many dollars each week for this, you won’t be surprised

and scrambling for the cash when it comes due.

6.) Utilities. Again, self

explanatory. Ours are all on one bill, break yours down if you have things

separated.

7.) Internet. Same as before. Oh,

and also—we both are still on our parent’s cell phone plans and have payment

worked out without monetary transactions. You’ll need to add that if need be.

8.) Food/Misc. Ahhh, the fun one! J In an ideal world, I would

break this down a bit more. I could list out an allotment for clothing,

toiletries, entertainment, clubs, yada, yada, yada. Instead, I add it all in

here and keep track of this money in a check register I carry with me

everywhere. I refer to this as my “extra money” fund. For this sample person,

on May 4th’s bill day I would add $150 to my fund. Then, if I go

grocery shopping that evening and spend $80, I would subtract that. I also

would add the “extra” money I talked about in the income section. Say I wrote

down that I would get paid the $500 in the sample budget, but I made $515. The

extra $15 would be moved to the “extra money” fund. If I made less, this would

be subtracted. Pretty much, anything not a regular bill gets added or

subtracted and anything that is over or short of what I budgeted gets added or

subtracted. This might be confusing—let me know. I do intend to go over this

more in the future. Also, this money still goes in my regular check register.

Yes, it’s a process.

9.) Car Payment. Joy oh joy.

10.)

Fuel/Car

Maintenance. This is also one I do weird, but for simplicity’s sake (and time

management), I’ll discuss that in a later blog post. For now, this is where the

money you’ll spend each week in gas, oil change, car washes, and the like goes.

11.)

Car

Insurance. Ours comes out automatically every month. I know some people pay

this annually or semi-annually. If that’s the case for you, this can be another

sinking fund.

12.)

Health.

It seems like no matter how hard I try, sneaky little medical bills, colds,

allergies, or something, always enter

my life. This is how I attempt to plan for it. If Tate gets sick and we head to

the doctor, the money is there. If I run out of Tylenol and have a major

headache, no worries, the money is there. You get the idea.

13.)

Life

Insurance. I feel like I’m talking an awfully lot about Dave Ramsey, but he has

a lot of great points. Life Insurance is hugely

important, especially if you have

small children. How will you keep your standard of living if, God forbid,

something happened to your significant other? How will you pay for the funeral?

I know it’s something horrible to think about, but do it. Dave recommends term

life insurance, and it makes so much

more sense than anything else out there. And, the younger and healthier you

are, the cheaper it is, so do it! Ours is literally $30 bucks a month for peace

of mind if anything would happen to either of us, or, God forbid, both.

14.)

Babysitting.

Not all of you would have this, and some of you most definitely do. You may not

pay weekly, but again, adjust it as need be.

15.)

Credit

Card. BOOOOOOOOOOOO!!!! L

16.)

Same

with both student loans—ICKKKKKYYYYY!!!! L

Then,

the next step is breaking it down. It will likely be a huge pain in the rear.

Don’t be surprised if you mess up, a lot. It’s okay. And don’t expect your

first budget to work perfectly as you’re using it either. Next month there’s a

high chance you’ll have to adjust. That’s normal, good even! You’re learning! J Here’s a few tips how to make

it go a bit easier though:

1.) Look at due dates. If something

is due the 1st of the month, hopefully it’s already paid, so you can

put it into the 25th. If not, pay it the 4th, and keep in

mind you may need to adjust in the future. If something is due the 15th,

be sure to pay it either the 4th or the 11th. And so on…

2.) Don’t be afraid to partial pay.

Say your credit card payment is like the one on the sample budget, $200 a

month. If you’re having problems finding a week you can pay that full $200, pay

$100 one week and $100 the next. The credit card company (or any other) won’t

care—they just want their money. Keep in mind the due dates though, and do your

best not to be late!

3.) Don’t shortchange yourself. Gas

is an easy one to do this on. If you typically spend $100/week on gas, but last

week you only spent $80, don’t take that to mean you can change your budget to

$80. Keep it at the $100. It’s better to have it and not need it then to be

short and have to find out where to take it from.

4.) Prioritize. Some of you may

have more expenses than income. If that’s your case, remember that having a

roof over your head, a warm temperature, and food to eat are your priorities.

You’ll also need a way to get to work. Continue to prioritize like that, and

look for areas where you may be able to cut back.

5.) Allocate every cent. You want your balance at the end to be zero.

Tell your money where to go. Don’t think, oh, I’ll just keep aside $50 to add

wherever I may need it. If that’s the case, put it in your Misc. fund, but

don’t completely leave it off the budget.

6.) Track your expenses. This is a

new thing in the Herendeen household, and very much still a work in progress. I

created an “expense report” Excel document on our desktop. Every time we spend a single cent it gets entered into our

expense report. The expense report is color coded based on what category it

falls under (food, home, entertainment, etc.). We do this for a couple of

reasons:

a. It allows us to see where we

might be able to cut back. If there’s a lot of yellow, for entertainment, that

might mean we need to cool it on the Redbox visits, just to name a possibility.

b. It makes us think twice about

spending something. If I’m in the store and see a snack that looks particularly

yummy, it’s so so so so easy to

impulse buy. BUT, if I think, is it worth putting it on the expense report? I’m

a lot less likely to say no.

c. It creates accountability. This

relates to b, but also is worthy to be on its own. If I know Corey will see my

McDonald’s Mocha on the expense report and pick on me for it, there’s a higher

chance I’ll keep driving instead of heading through the drive thru.

7.) Stick with it. I said before

it’s not going to be easy. Just keep in mind it’s so worth it in the end!

And

that is how you create a budget! YOU DID IT!!! J I truly hope I communicated it well… and once

again, don’t be afraid to ask if you have questions. I 150% promise not to

judge you… doing this isn’t easy. I understand. I just want to be able to help

people avoid the all too easy to find pitfalls of finances!

Love it. I"m terrible at budgeting, but started a very strict budget last year when I moved to Toledo...living on approx $120/week made it absolutely necessary!

ReplyDeleteCourtney, pretty good info but you must work on your grammar if you want people to take your blog seriously. "Corey and I's"...really?

ReplyDelete@The Equalizer. I am laughing at your comment even though it was pretty mean. It's such a common mistake that we could let that slide, no? I copied this last night and did my budget as I had bought a columnar pad hours before and had no idea how to use it. I knew I needed it, though! Blessings, Courtney!

ReplyDeleteHoly Heck! More bills than money coming in! Budget here we come. Love your budget plan. I'm going to do minimum credit card payments on all but one and knock the largest out first! They are all getting put away today until I can see zero on every single one.

ReplyDeleteI've working on my Columnar Budget for a year now and working to improve each month. this has helped. Thank you!

ReplyDeleteI have been using a columnar pad now for 3 years for budgeting, but I started feeling like I wasn't using it as best as I could. Found this blog and literally had an aha moment - and more confirmation that I need to get on Dave Ramsey's class STAT! Thanks for sharing :)

ReplyDelete